A Boutique Firm Focusing on Consulting & Ventures

Financing for Buying a Business

Thinking About Acquiring a Business Using Financing?

Financing is a great way to acquire a business because you can spread payments out over time.

Financing may be an option for you, if you do not have enough liquid cash to acquire a business that you want.

The pool of home buyers would be minimal if there was no home lending.

For example, you can acquire a $1mm business with $200,000 down.

Buying a Business becomes much more feasible and possible with a loan.

Our lenders are top notch and it’s an easy process to get pre-qualified.

How Financing Affects Cash Flow

With our financing lenders and partners you can acquire a business with 20% or in some cases, 10% down.

This allows you to open the doors on what type of business you can acquire. Which will often reflect in terms of cash flow.

A $1mm business might have cash flow of $300k. Whereas a Business of $200k might have cash flow of $70k.

You’re putting the same amount down. But the end result is staggering in terms of the net cash you’ll walk away with.

In 10 years that $200k business might give you $700k net profit.

In 10 years that $1mm business might net you $1.9mm all things considering.

That is a staggering difference and it cost you the same amount on the day of closing.

Financing allows you to leverage a 5x profile.

How to Work With Us

We help guide you to the right business as a buyer. Value is in the numbers, but also in the intangibles. Of course, the multiple has to work, but we look for unique intangibles that suggest there is value beyond what is in the numbers that other PE firms are looking at. We want value, meaning the proper multiple but also the right fit, meaning it was the right owner and the right fundamentals before you are the successor.

We look for an industry and fundamentals that align with your core competency. We look for companies that would potentially be appropriate fits for you if the logistics and financials are synonymous with your target acquisition criteria.

Example Target Criteria would be as follows.

- Asking Price: What price range do you want based on what you feel comfortable with? Financing allows you to put 10%-20% down instead of 100% down.

- Revenue range: While this may seem irrelevant You’re not going to pick a business you can’t handle.

- EBITDA range: Ultimately, this is the biggest metric most folks look for. What’s the net takeaway after everything is said and done.

- Industry: Is there a specific domain you are looking in. If you’re highly experienced in manufacturing for instance, you probably don’t want to focus on acquiring a business that is heavy in software application.

- Location: Does the business have to be in a specific city or state or are you looking for a national business or an online remote business.

- Brick and mortar presence: Are you looking for a physical stores and/or locations, or are you looking for a business that is 100% online or remote.

- Employees: How big is the company that you want to take over?

- Licensing Requirements: Do you have licenses and are you looking for a business with a license.

- Existing Contracts such as Lease Requirements: Is the business locked in to a lease or space that you need to assume or take possession of.

- Financing: Are you looking for an all cash deal or looking for a lender. SBA approved or non-conventional financing. We have connections with lenders.

- Etc.

Work with us to secure your next company, and learn about our financing options.

Here Is What We Need From You

Here is what we need from you to start the financing process, to start the initial underwriting:

- Last three years personal and business tax returns (if you have business returns) 19,20,21

- Personal Financial Statement (attached)

- Myfico credit report – Need the full report in order to run a DTI on you

- Short resume on experience

Retain Us for Your Acquisition

Why Us?

JARBLY is a Boca Raton, FL firm with representatives all across the country, working in conjunction with Trend Realty in Sarasota, FL that focuses on its core competencies of acquisitions, real estate, and disruptive ventures. We have generated over 30 million YouTube views discussing business and mindset, have positioned our own assets for sale, and we have helped countless owners exit. You can rely on JARBLY to assist you in getting an exit successfully.

How We Help You Acquire

When it comes to acquiring businesses there is a thorough process we help with:

- Have a list of questions to ask to ask the seller or listing agent

- Understand how to analyze the deal

- Assess the proper valuation

- Know licensure requirements, meaning are you eligible from a state perspective to buy and/or run the business

- Understand the proper business formation after takeover

- What does the deal structure look like

- What does the current lease or property/inventory ownership structure look like and how do you transfer it, with a good deal

- How does billing work with the current business – is it more complicated than just switching the name and the bank account

- Where you should be looking to maximize the offer in terms of negotiations, if necessary

- Present a proper LOI to make the seller realize it’s more than just a non-binding formality

- Have the knowledge to know how to get your LOI accepted beyond just the numbers

- Is there financing involved and prepare properly with a lender

- Know how to proceed and prepare with due diligence, meaning what questions to ask

- Make sure the business continues its operations until close

- Make sure there is smooth transition before close and after close

- Closing assistance when the transaction is ready to go through

- How to transition your staff with a new owner

- How to transition customers, clients after sale

- Consulting opportunities and marketing opportunities after the sale to maintain the two most important goals post-acquisition: stabilize and ameliorate

Experience in Deal-Making

Don’t you want to bring aboard a team that has experience not only in getting acquisitions done, but are highly experienced in consulting businesses and helping them grow. In essence, we understand where the value is and where the fastest path is to grow the company.

Our Guidance with Financing to Buy the Right Business so You Get the Cash Flow You Need

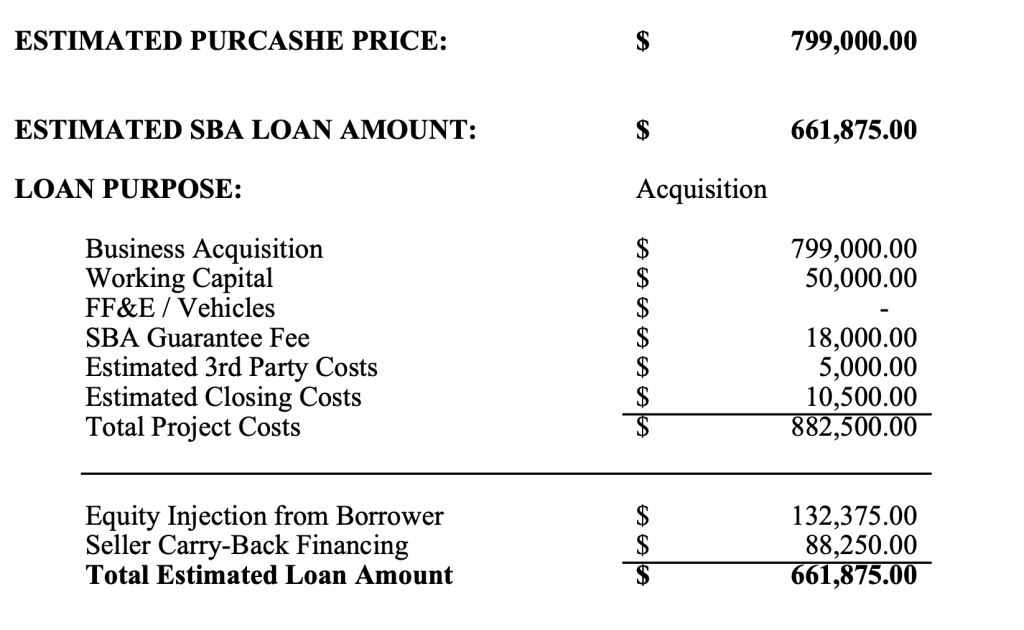

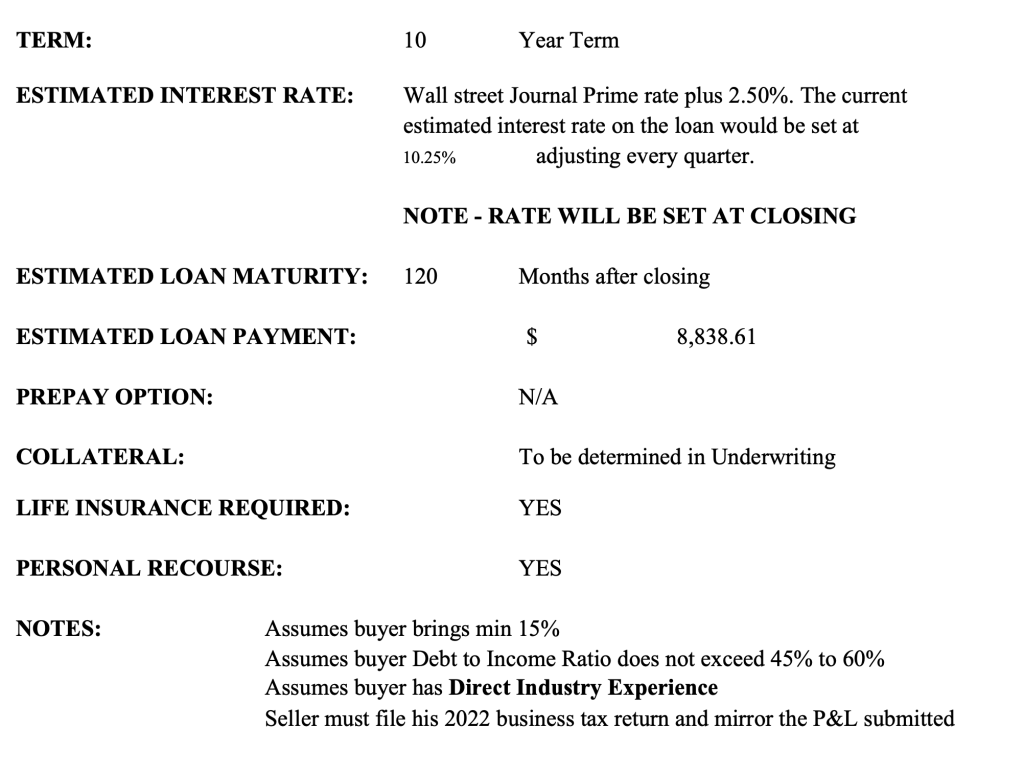

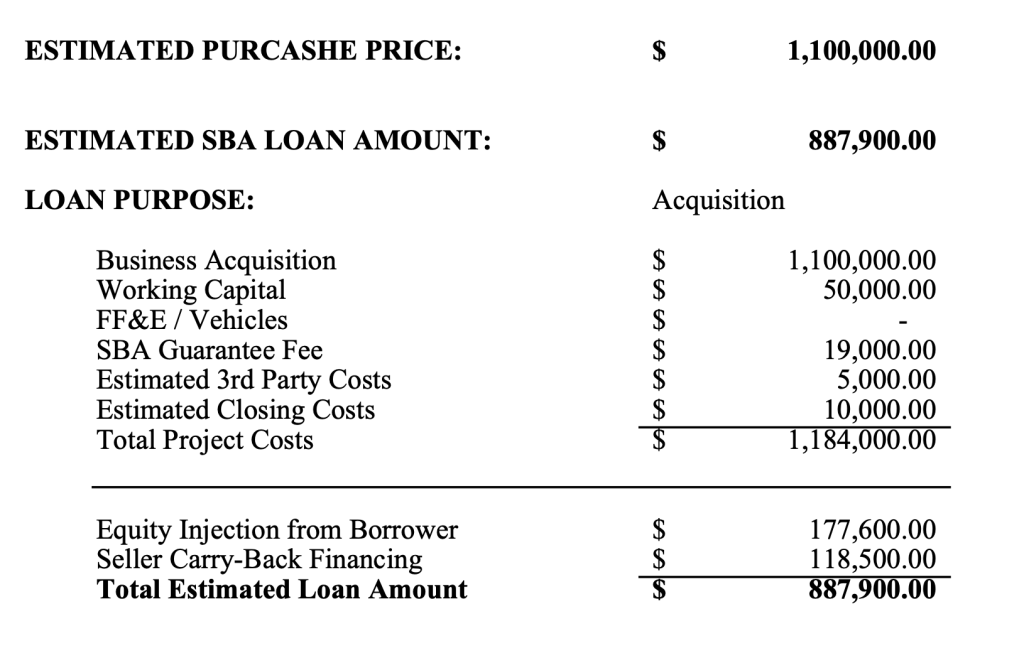

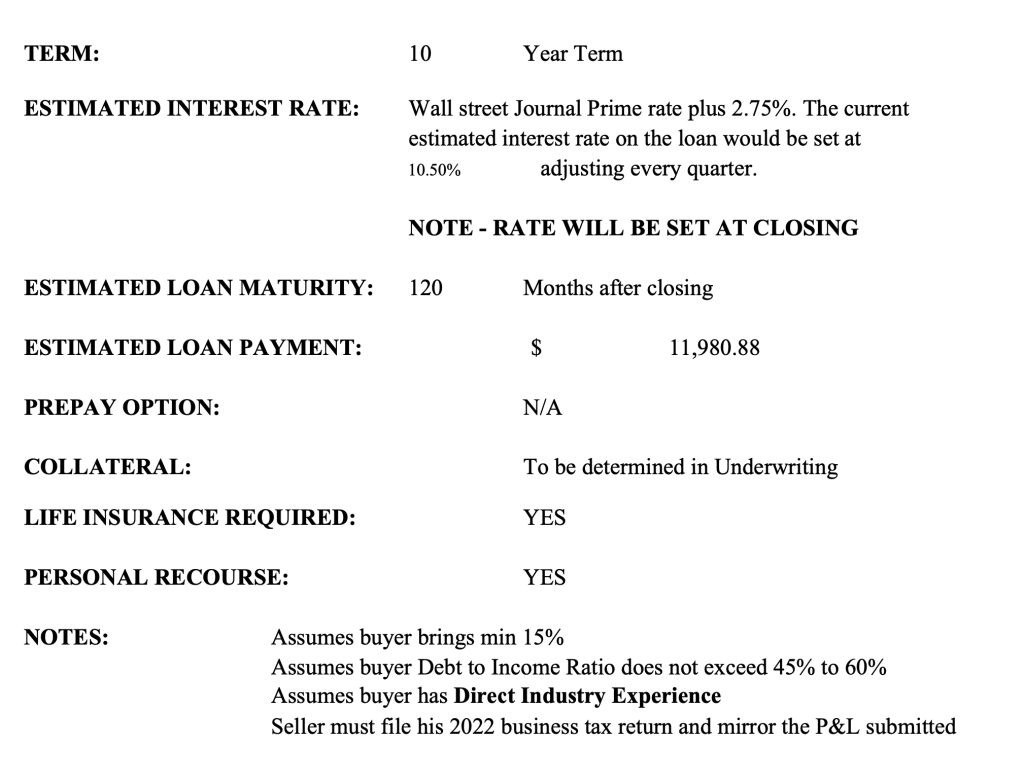

Financing Examples Enclosed

Attached are several scenarios relating to financing.

This way you can see what the payments look like.

As you can see the cash flow of the business should in most cases

What is a SBA 7(a) Loan?

The SBA 7(a) Loan is a government backed program that assists buyers of businesses.

Borrowers can borrow up to $5 million through the program, with repayment terms of up to 25 years.

SBA 7(a) loans are attractive to small businesses because they offer high leverage and fixed-rate terms. Additionally, 7(a) loans are non-recourse, meaning that the small business owner is not personally liable for the loan.

What Down Payment is Required?

Business acquisitions can be financed up to 90% by a lender. 10% down oe 20% down are common scenarios in a business acquisition when you and the business you are seeking is qualified.

Can You Use an SBA Loan to Buy part of a Business?

The quick answer is no.

SBA 7(a) loans cannot be used to purchase part of a business.

You must buy 100% of the business if you are using an SBA 7(a) loan.

All that you can do is work out a consulting agreement up to 12 months, which you can bake into the deal in terms of a transition period. This is typically done if the seller wants more money than what the SBA 7(a) will qualify the business for and there are legitimate reasons for the consulting agreement.

Can I Do an Earn-Out or Seller Note with the Seller With an SBA 7(a) Loan?

Earn-outs are not permitted under SBA loan regulations. You cannot structure a deal where the seller gets paid out over several years on top of what you are paying back the government for the loan.

It could lead to conflicts.

A seller note is one way to bridge the gap if the numbers aren’t aligned, but this cannot be more than 5% of the business purchase price.

There are various ways to get a deal done if the SBA and the seller are far apart in numbers. That’s where an experienced team and business broker like JARBLY comes in to play.

Let Us Do the Vetting

If you retain us at JARBY we will find businesses that match your exact target criteria.

The average person spends 70+ hours when acquiring a business.

This goes into finding listings on the market, scoping out numbers, retrieving information, signing NDA’s, scoping through information, and more.

Ultimately you’re trying to find if it is a fit with your target criteria.

Example Target Criteria would be as follows.

- Asking Price Range:

- Revenue Range:

- EBITDA Range:

- Location:

- Industry-Specific:

- Active Role vs Passive Role:

- Online Business vs Brick and Mortar:

- Etc.

There are more target criteria you can include but those are the main ones we at Jarbly really expect from you to narrow down so that we can do our best to align a business with your needs.

Not only do we search for on-market listings, but we have access to off-market listings through our network.

We have the ability to line up businesses for you. That match your exact target criteria and we do all the heavy hitting.

You trying to buy yourself and save money on representation, might not be advantageous to you.

Buying a Business is a major decision. Don’t you want an experienced person guiding you to something that’s a good fit and vetted. It’s better having guidance when making a large transaction. When making big decisions it’s usually important to have multiple people decide on it. When you retain JARBLY you can have peace of mind we are comforting you with a decision.

You might err because you have less businesses to view and interact with, you might not be able to negotiate properly, you might upset the seller, and you might have trouble getting through the essential items in a transaction because this might be especially newer for you.

You also are probably less likely to structure a deal that nets you more in the end because of upfront vs earn-out scenarios, financing options, and negotiation tactics.

If you want maximal value, choose a quality professional.

What Our Processes Look Like to Save You Time and Get You the Maximum Price

From our group, we would:

– Scope out businesses in your industry, even in secondary industries you may not think of

– Look in other states that could be transferred or that are running remote

– Get an e signed nda on file

– Get detailed memorandum/prospectuses for review

– Get financing on the deal lined up for you

– Have calls and conversations with sell-side representation and management to ascertain where the deal is

– Help prepare an offer in an LOI

– Assist with transition through due diligence and close

To get started you can engage us by selecting the button below and we would love to hear your target acquisition criteria.

Retain Us for Your Buying Search

Buy-Side Processes

- TARGET CRITERIA DEFINITION

- INDUSTRY-SPECIFIC RESEARCH

- BUSINESS RESEARCH AND VALUATION ASSESSMENTS

- LISTING AGREEMENT MATERIALS

- NDA IN PLACE

- CONFIDENTIAL INFORMATION MEMORANDUMS

- DETAILED PROSPECTUS AND EVALUATION MATERIAL

- TARGET FULFILLMENT

- FINANCING PRE-QUALIFICATION

- GENERATE LOI

- PRESENTATION OF LOI

- NEGOTIATIONS AND COUNTER-NEGOTIATIONS

- DUE DILIGENCE PERIOD

- FINANCING PROTOCOLS

- ESCROW AND CLOSING

- TRAINING AND TRANSITION

We Help You with Your Business Acquisition with the Best Value for Your Buying Power to Make Sure You’re Maximizing the Cash Flow with Your Funds

Proper Protocols for Financing

When interested in a business, it is important to understand what the typical processes are that expected of you and this could be a tedious process to do them in order to build rapport with the seller’s agent and the seller. If not, you risk losing the deal or getting bested on the numbers because you missed necessary steps.

- Be Cordial and Respectful of Processes -We really love speaking to buyers. We love to understand what they are interested in. This business only or a business that matches certain industry criteria so we can steer you in the best direction for you.

- Submit your Pre-Qual Info – See what businesses you qualify for based on your net worth, tax returns, cash flow, etc.

- Read the Prospectus and CIM – As a rule, make sure you read the prospectus in full before asking questions. This will reduce redundancy.

- Go through the Broker- Do not circumvent the broker as a means of trying to speak directly with the seller to get a ‘better price’. A call will be arranged when you are serious. Sellers will communicate to brokers why did you waste my time, so avoid a bad situation altogether.

- Do your HW – Look up the business. Go to the website. Place a small order. See if they are legit. If you don’t know the industry, make sure you do your HW on the industry.

- Generate a Pre-Qual on the Business – We work with our lenders to get pre-qualifications on the business you are seeking. They can run numbers to see exactly what the SBA or a non-conventional lender would lend on it.

- Submit a Ballpark Offer – before you hop on the call with the seller, you want to gain trust with the broker and seller. You don’t have to show proof of funds right away, but you want to show you’re serious and in line with valuation. If you are not close and you just want to get a business for pennies on the dollar or a fraction of their asking price, and finagle a deal by getting 90% or more of seller financing, then you are going to be worlds apart. Be upfront about that from the start. Don’t waste anybody’s time. A seller wants 100% cash, it doesn’t mean they won;’t be flexible but we do not waste our client’s time with bad deals. If you say we are looking to put $x down and $y over time if everything checks out and matches the prospectus financials, we can move to next steps fairly quickly.

- Submit an LOI – Generally, if you are in the same ballpark, we can have you on the call with the seller. From there, your intention of the call should be to make sure boxes are checked off so that you can submit a formal LOI and get the process started. Calls are not preliminary in nature. You have a prospectus in hand that took hours and hours with the seller to formulate to answer 95% of your questions. Calls are there to verify what you need to know – is the seller a nice person, legit, do they have what it takes to be a partner or stay on, what are their intentions with the sale, etc.

- Financing Protocols – Allow the lender to guide you through the process of what it will take to close.

- Due Diligence – once we have an acceptance in the form of an LOI, then we can move to due diligence. This takes anywhere from 7 days to 60 days, on average. 7 days if this a fairly simple all cash deal or low upfront. 60 days if you need several parties involved including financing for a large multi-million dollar deal. This is where you want to get tax returns, bank statements, and any other questions you need. An on-site visit may be appropriate but impacting the seller’s sales probably won’t be something that will fly without a deposit.

- Closing – Once everything checks out, you will get details for proper closing instructions. Usually this will be done by wire through escrow or directly to the owner based on the nature of the deal.

- Transition and Training – This is where the seller will stay on to help you understand everything in the deal. This will be baked in to the terms. You want to understand processes, but taking advantage of the seller is not something you want tyo do. The seller, unles otherwise agreed, is exiting. You want to be well trained on the business, but you are also buying a business which takes experience to run. No business venture is without risk, including one that you are buying no matter how many years it has been running successfully. You are the new owner now.

- Consulting – After the transition period is over, the seller is usually available for consulting. Hire them per hour or incentivize them with a % of sales they bring in if they are good to keep around to produce for you. Often times, a seller would like to be involved, but they want to be compensated for it. Make it a win-win and don’t expect services for free after the training period is over just because you bought a business from them.

Not Sure if Now is the Right Time?

An acquisition is not as complicated as you may think.

It never hurts to be prepared and see what is out there and what it will take.

You are in control to prepare an offer and LOI and see if there is a fit.

If you are on the sidelines you won’t be able to do some bigger deals. When is it ever the perfect time. You have to be calculated, but you may have to take calculated risk.

Who Financing is Not For:

Don’t use financing if you are stretching too thin

Don’t user financing if you don’t have enough additional cash to cover the payments. No one expects you to be liquid the entire term of the loan, but you should t take out a loan with no cushion in place.

First, the the acquisition transition may not be as smooth as you anticipate.

There May be bumps. You should have some expectation of a cushion so you don’t have so much intense pressure post-close.

Acquiring a business is an exciting thing and you want to have good feelings. This is a Long term investment. This isn’t something you should buy expecting a huge flip.

You are buying something that might have taken years to build. Now you want to grow it and it may take years to get it to a place you are proud of.

You want to understand the systems

You want to understand where the growth is

You want to be patient.

How Long Does Acquiring a Business Take:

It takes roughly 30-60 days to get a financing deal done depending on how fast you deliver documentation that is requested.

Use this time wisely. Learn the industry. Understand the business. Leverage the time to understand how you will grow the business once you acquire and start.

Retain Us for Your Buying Search

Get Started with JARBLY on Your Buy-Side Opportunity with Acquisition Financing

It only takes a few minutes and a couple of materials on your end to get pre-qualified for a business acquisition financing loan.

Engage JARBLY LLC to get started you businesses that fit your criteria, that are fully vetted and meet what you are looking for. JARBLY’s sole mission is to assist you in purchasing a business with a great deal.

In Closing

If you’re interested in one of our listings, we will let you know if it qualifies for financing.

If you have another business you are interested in but want to use us for financing, let us know. We have lending partners who can run a qualification on it. We understand typically in a short period of time if it will qualify and for how much it will qualify for and be for the down payment and monthly payment.

Let us know if you are interested in financing. Reach out here if you want financing on a business.

Thank You.

We look forward to working together with you assisting in your next acquisition of a business or asset.

Play

Play